The idea behind a mutual fund is to provide convenience to retail investors, who do not have the time or inclination to analyse individual companies to invest in. So a mutual fund, a specialist in this field, does it for them. However, the growth of the mutual fund industry in India with 40 companies operating mutual fund schemes has resulted in another dilemma for investors – analysing individual schemes in order to shortlist the ones in which to invest their money.

Generally, an investor would look at, inter alia, the following factors while shortlisting funds:

- Past performance;

- Category (large cap, small and mid cap, etc.);

- Comparison with other schemes.

However, usually this exercise is carried out only at the time of investing in the fund and is not continued once the investment has been made. In this article, we wish to highlight why it is important to monitor fund performance at least once a year if not on a regular basis. Especially, it becomes really important to identify and understand if there are any significant changes in the fundamental structure of the fund and how it is managed. To help explain this, let’s take a look at ICICI Value Discovery Fund.

A case study – ICICI Value Discovery Fund

You are sitting on 1 January 2011 contemplating whether to invest in the fund or not. Here are some of the facts pertaining to the fund as on that date:

- CAGR since inception till 31 December 2010 – 29.31%. To put this result in context, an investment of Rs. 10 lacs in the fund at inception would have become more than Rs. 50 lacs.

- Category – Small and Mid cap

- Assets under management (AUM) – Approx. Rs. 1,600 cr.

- Fund Manager – Mr. Sankaran Naren

By the looks of it, the fund has performed exceptionally well (even in comparison to other funds in its category). Given this analysis, you decide to invest in the fund considering that you have a long time horizon.

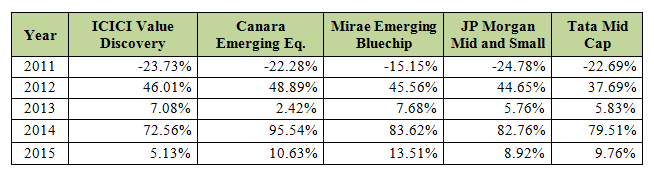

Now let’s analyse its performance 5 years since you first invested in the fund. Below is the annual performance of the fund compared to other funds in its category: As you can see, up until 2013 ICICI Value Discovery kept pace with other funds in the small and mid cap category. However, in 2014 and 2015 it started underperforming. The question to ask is whether this is just an aberration which will be corrected in the years to come or is there something more going on behind the scenes? To answer that question, let’s dig a little deeper.

As you can see, up until 2013 ICICI Value Discovery kept pace with other funds in the small and mid cap category. However, in 2014 and 2015 it started underperforming. The question to ask is whether this is just an aberration which will be corrected in the years to come or is there something more going on behind the scenes? To answer that question, let’s dig a little deeper.

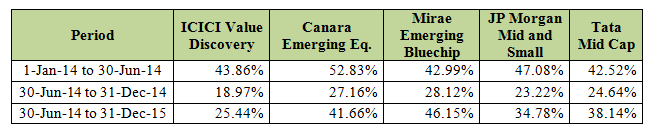

A further breakdown of performance clearly reveals that the underperformance started since the second half of 2014: Aha! That gives us something to investigate. Let’s see which companies the fund has been adding to its portfolio since 31 May 2014:

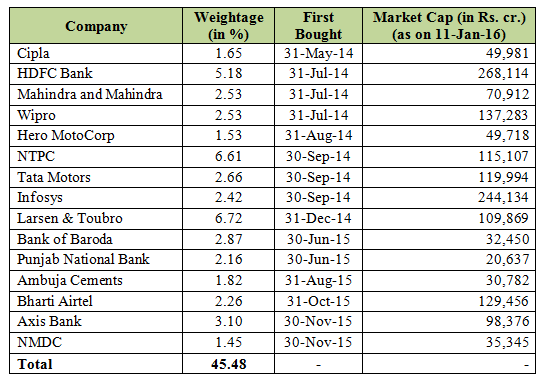

Aha! That gives us something to investigate. Let’s see which companies the fund has been adding to its portfolio since 31 May 2014: As you can see, the names above can hardly be considered small and mid cap companies[i]. These are either large cap or giant companies in the context of Indian stock markets. And they constitute a whopping 46% of the portfolio.

As you can see, the names above can hardly be considered small and mid cap companies[i]. These are either large cap or giant companies in the context of Indian stock markets. And they constitute a whopping 46% of the portfolio.

So, why is a fund which is supposed to invest in small and mid cap space adding large cap companies?

Here’s what we feel is the reason for it – Assets under Management (AUM).

You would recall, when you first invested in the fund at the beginning of 2011, the AUM was approx. Rs. 1,600 cr. By the end of 2015, however, the AUM had swelled to over Rs. 11,000 cr. – a rise of almost 7 times in the 5-year period[ii]. To put this into context, currently, other funds in the small and mid cap category usually manage around Rs. 1,000 cr. or less.

Now you might wonder what the AUM has to do with a fund’s performance or investment strategy.

Well, quite a lot in fact. The Indian equity markets lack depth and Rs. 11,000 cr. is way too much money to invest majority of it in small and mid cap Indian companies. This necessarily means that the fund manager has to look for bigger companies to invest in.

Considering the above analysis, it would be better to now think of ICICI Value Discovery as a large cap fund which has a small exposure to mid cap companies. And accordingly, its performance going forward should be on similar lines as that of other large cap funds. Investors’ expectations from this fund should also now change to reflect the change in strategy.

Regular monitoring to the rescue

A fund can undergo numerous changes in its lifetime which can impact its future performance such as change in fund manager, investment style, etc. Regular monitoring would uncover these changes in time and help understand whether past performance can be translated into future performance.

Notes

[i] There is no specific rule but generally, companies having a market cap less than Rs. 15,000 cr. are considered as small and mid cap companies

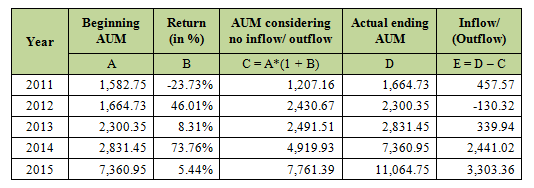

[ii] The table below summarizes how the AUM has changed over the years (in Rs. cr.): The rise in the AUM can be attributed to the following two reasons:

The rise in the AUM can be attributed to the following two reasons:

- Increase in the value of existing AUM; and

- New AUM – the fund’s exceptional performance in the past has attracted new investors and it has seen net inflows of approx. Rs. 6,500 cr. during the last 5 years.