By Shashank Gupta & Kritika Gupta

Insurance companies come up with a variety of reasons in order to sell insurance products – some market it as a vehicle for investing money for retirement and others as securing the future of children. But is it as compelling as it sounds?

What is a Traditional/ Endowment Insurance Policy

Traditional/ endowment policies are those policies in which periodic premiums are paid by the insured person and a lump sum is received either on expiry of policy period or on the death of the insured (whichever is earlier). The premiums for such policies consist of the following two components:

- Premium towards risk cover, i.e. the sum assured in the event of the death of the policy holder; and

- Premium for investment purposes.

Insurance companies love endowment policies since they are able to invest the premiums collected to generate a return (much like banks). A portion of this income is returned to the policy holders at the time of maturity (after deducting their fees and expenses of course).

Returns from a Traditional/ Endowment Insurance Policy

These policies are bought mainly because the amount one is likely to receive at the time of maturity looks enormous in comparison to the premiums paid. However, most people do not calculate the actual annualized returns from these policies and are overwhelmed by the math involved.

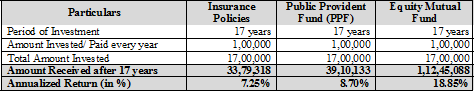

In the table below, we have compared the returns of a typical endowment policy with other investment vehicles:

As one can see, the return from an endowment policy is a measly 7.25%. What makes this worse is the fact that this return is merely an illustration given by the insurance company and is not guaranteed. The returns generally turn out to be lower than what is initially illustrated.

When we compare this return with that generated by an equity mutual fund, it is a mere pittance. What is pertinent is the fact that the return of 18.74% is not a claim but has actually been earned by the fund over a 17 year period from 1 April 1998 (and this is not even the best performing fund). Even an unmanaged index such as the Nifty has earned 13.38% annually over this period beating the endowment policies by a margin of more than 6% per year.

While those who understand equity investing would not be surprised by this, the fact that a no risk instrument like a PPF is able to generate better returns than an endowment policy should be a wake-up call for many.

If not endowment, then what?

For disciplined investors, it would be best not to mix insurance and investments. For investment needs, one should invest systematically in a basket of assets like equity, debt, etc. And to cover risk of life, it is advisable to purchase adequate term insurance.

Term insurance policies are those policies in which only risk of life is covered and there is no investment component. Accordingly, the premium for these policies is much lower than endowment policies. To set a perspective, a 25 year old healthy male can get a cover of Rs.1 crore for as little as Rs.800 per month! Thus, the hefty premium that one would have paid in a traditional insurance policy gets freed up which can be invested elsewhere where a much better return can be earned.

So, the next time an insurance agent knocks on your door, ask him to compute the percentage annual return from the insurance policy he is trying to sell to you as a “sound investment”.